The U.S. presidential election cycle is one of the most influential periods for global financial markets. As the nation heads into election years, the uncertainty surrounding political outcomes often sparks significant volatility, creating both risks and opportunities for traders. Understanding how elections impact the markets and crafting appropriate strategies can make all the difference in navigating these unpredictable times. This article explores how election years affect the markets and presents effective trading strategies for capitalising on the resulting conditions.

Understanding the Political-Economic Landscape

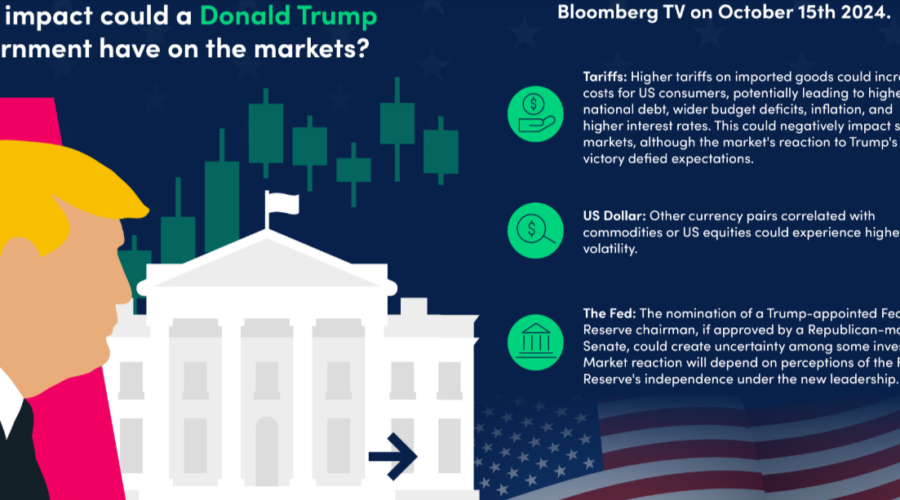

Elections bring about a level of uncertainty that has a direct and often dramatic impact on financial markets. Investors and traders closely watch the political landscape as they anticipate the economic policies that will come from the new administration. The possibility of regulatory shifts, tax changes, and trade policy reforms generates a sense of unpredictability, which can prompt sharp market movements.

The political dynamics surrounding a U.S. election year are critical in shaping investor sentiment. While some investors may view a change in leadership as an opportunity for growth, others may fear instability. This divide can lead to periods of heightened volatility, especially when election outcomes are too close to call or when the political environment seems particularly uncertain. This site web will provide more information.

Analysing Market Trends During Election Cycles

Market behaviour during election years is often characterised by increased volatility. This heightened volatility results from a mix of investor anxiety, speculation, and uncertainty over future policies. As the election approaches, investors attempt to forecast potential outcomes and position themselves accordingly, which leads to erratic price movements. However, understanding these market cycles can provide traders with a strategic advantage.

Volatility is typically higher in the months leading up to the election and in the immediate aftermath of the results. Investors tend to take a cautious approach, moving funds into perceived safe-haven assets like gold, U.S. Treasuries, or the Swiss franc. These assets are traditionally seen as stable during times of uncertainty, making them attractive to risk-averse traders. Conversely, sectors tied to the election’s outcome often experience extreme price fluctuations. For instance, industries that depend on government spending, such as defence or healthcare, might react positively to the prospect of a particular candidate winning, while industries that fear heavy regulation, like technology or fossil fuels, may experience declines.

Tailored Trading Strategies for Election Years

Given the potential for significant market fluctuations during election years, traders need to adopt strategies that can effectively manage risk while capitalising on market trends. One such approach is trend-following, which involves identifying and investing in the direction of the market momentum. Since elections often bring drastic shifts in sentiment, trend-following strategies can help traders capture the major moves in the market, whether they are upward or downward.

Another effective strategy during election years is sector rotation. Certain industries tend to perform better depending on which candidate is leading in the polls or ultimately wins the election. For instance, defence and healthcare stocks may rise if a candidate is expected to increase government spending in those sectors, while tech stocks could see declines if regulations or antitrust concerns are heightened under new leadership. By rotating investments between sectors, traders can maintain a well-balanced portfolio that capitalises on these shifts.

Deciding between long-term investment strategies and short-term speculative trades is another important consideration. Long-term investors might prefer to adopt a more patient, buy-and-hold approach, focusing on companies that they believe will thrive regardless of the election’s outcome. On the other hand, short-term traders might take advantage of market noise, making quick trades based on shifting sentiment or news events. Balancing these two approaches and knowing when to pivot between them can significantly enhance a trader’s success during election years.

Managing Risk During Election Years

The uncertainty of an election year makes risk management a critical aspect of any trading strategy. Diversification is one of the most effective ways to reduce risk, as it helps protect against significant losses in any single asset class. By diversifying across various asset types, sectors, and geographical regions, traders can mitigate the impact of election-related volatility on their portfolios.

In addition to diversification, setting stop-loss orders can help protect investments from sharp declines. Since market movements during election years can be dramatic, stop-loss orders ensure that positions are automatically sold when they reach a predetermined price, limiting potential losses. Traders should also monitor their positions frequently, especially during periods of high volatility, to ensure that they are in line with their risk tolerance.

Scenario planning and stress testing are other essential tools for managing risk. Stress testing involves analysing how a portfolio might perform under various election outcomes, allowing traders to gauge the potential impact of different political scenarios.

Conclusion

Successfully navigating the financial markets during U.S. election years requires a combination of strategic foresight, risk management, and psychological discipline. By understanding the political and economic dynamics at play, traders can identify opportunities and develop effective strategies to profit from market volatility. Whether utilising trend-following strategies, sector rotation, or options trading, traders must remain adaptable and prepared for the unique challenges that each election year presents.