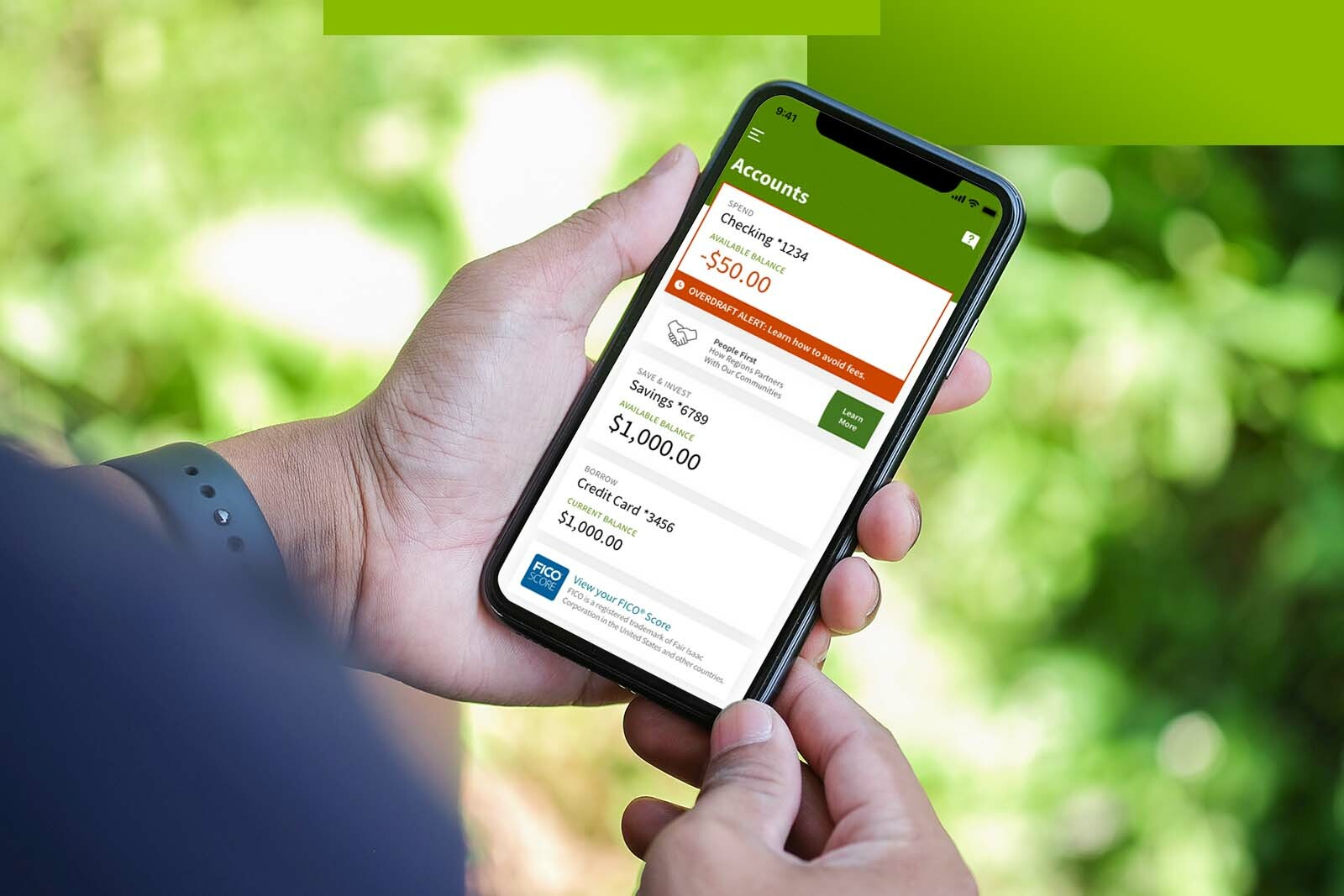

Overdraft protection provides a safety net for preventing overdrawing of funds from a bank account. It acts as a line of credit to cover transactions that exceed the available balance, helping to avoid costly overdraft fees and declined payments.

By linking a checking account to a savings account, credit card, or line of credit, overdraft protection ensures that transactions can still be processed even if there are insufficient funds in the account. This convenient feature helps to maintain financial stability and peace of mind for account holders.

Whether it’s a small purchase or an unexpected expense, overdraft protection acts as a safeguard to ensure that payments are made and transactions are processed smoothly, without the worry of insufficient funds.

Credit: doingmoretoday.com

What Is Overdraft Protection?

Overdraft protection is a financial service that helps prevent your bank account from going into negative balance. It works by linking your checking account to another account, such as a savings account or a line of credit. In case you make a purchase or withdraw more money than you have in your account, the overdraft protection kicks in and covers the shortfall.

This means that instead of the transaction being declined or a fee being charged for insufficient funds, the bank will cover the difference. One of the benefits of having overdraft protection is that it provides you with peace of mind, knowing that you won’t be caught off guard by unexpected expenses or mistakes.

It also allows you to avoid embarrassing situations and the hassle of dealing with declined transactions. By having overdraft protection, you can have more financial flexibility and avoid potential fees and consequences.

Types Of Overdraft Protection

Overdraft protection comes in different types, and it’s important to understand their pros and cons. Firstly, there’s the linked account overdraft protection, where funds are automatically transferred from a linked account to cover an overdraft. This provides convenience and avoids overdraft fees, but it may still incur transfer fees.

Another option is overdraft lines of credit, which offer a predetermined credit limit. This provides flexibility and may have lower interest rates, but it can still incur interest charges. Lastly, there’s overdraft protection with a credit card, where the card is used to cover overdrafts.

It offers flexibility and rewards, but it can lead to high-interest charges. When choosing the right overdraft protection, consider your financial habits and needs, and compare the costs and benefits of each type.

Avoiding Financial Disruptions

Overdraft protection is a crucial tool in avoiding financial disruptions. It acts as a defense mechanism against bounced checks and declined transactions. The impact of overdraft fees and penalties on your finances can be significant, leading to unnecessary expenses. By utilizing overdraft protection, you can prevent these issues and protect your credit score.

With overdraft protection in place, you can rest easy knowing that you won’t face the embarrassment and inconvenience of having your transactions denied. It provides a safety net and ensures that your payments are processed smoothly, giving you peace of mind.

Overall, overdraft protection is an essential aspect of managing your finances effectively and avoiding unnecessary complications. So, make sure to explore this option to protect your financial stability and reduce stress.

Managing Unexpected Expenses

Using overdraft protection as a safety net during financial hardships can provide peace of mind. Dealing with unexpected bills and emergency situations can be challenging, but having overdraft protection allows you to handle these expenses without stress. With overdraft protection, you don’t have to worry about insufficient funds and can avoid costly overdraft fees.

It acts as a cushion, allowing you to cover unexpected expenses and manage your finances effectively. Whether it’s a medical bill, car repair, or any other unforeseen situation, overdraft protection offers you the flexibility and security you need. By having this safety net in place, you can confidently handle unexpected expenses and focus on regaining financial stability.

Don’t let unexpected bills catch you off guard – leverage overdraft protection for a smoother financial journey.

Monitoring Your Finances

Monitoring your finances is crucial to avoid overdrawing your account. Utilize online banking tools and alerts to keep track of your account balance and transactions. With automatic transfers and reminders, you can better manage your finances. Stay aware and avoid unpleasant surprises by actively monitoring your account.

Maintain control by taking advantage of the digital tools available to you. Keep track of your transactions and stay on top of your account balance. By being proactive and utilizing these online resources, you can prevent overdrafts and maintain financial stability.

Take control of your finances today and set up automatic transfers and reminders to stay on track. Keep a close eye on your account balance and transactions to ensure a secure financial future.

Communicating With Your Bank

As you communicate with your bank, it is essential to discuss the terms and conditions of overdraft protection. This includes understanding the associated fees and policies, as well as negotiating for better terms. Building a clear understanding of these aspects can help you manage your finances more effectively and avoid unnecessary fees.

By engaging in open and honest conversations with your bank, you can ensure that you are well-informed about the specific terms and conditions that govern your overdraft protection. This proactive approach empowers you to make informed decisions and take control of your financial well-being.

So, take the initiative to have these discussions and protect yourself from any surprises in the future.

Building A Financial Safety Net

Building a financial safety net is crucial to avoid relying solely on overdraft protection. One effective method is creating an emergency fund, which provides a cushion for unexpected expenses. By setting aside a portion of your income regularly, you can gradually accumulate funds that can be used in times of financial need.

Additionally, seeking professional financial advice can help you develop long-term financial plans that go beyond just overdraft protection. A financial advisor can guide you in making wise investment choices and developing a comprehensive financial strategy tailored to your individual goals.

Taking these steps can provide added security and peace of mind, ensuring that you have multiple layers of financial protection in place.

Conclusion

Having overdraft protection can provide a safety net for your finances. It can help you avoid costly fees and penalties when your account is low or when unexpected expenses arise. By linking your checking account to a separate account or line of credit, you can ensure that any transactions that would result in an overdraft are covered.

This not only saves you money but also gives you peace of mind, knowing that you won’t be caught off guard by unexpected charges. Additionally, overdraft protection can help you maintain a positive credit history by preventing negative marks on your account.

It’s important to understand the terms and fees associated with overdraft protection and choose the option that best suits your needs. So, if you want to stay in control of your finances and avoid unnecessary stress, consider opting for overdraft protection.